What Are the Features of a Banking App?

7 min read

Last Updated on January 24, 2022 by Journal Fact

One of the most beneficial features of a Banking App is its ability to manage your accounts. This feature helps you save time and prevents you from having to visit the ATM. With a good app, you can set up automatic bill-pay features, schedule payments, and set customizable alerts. With a banking app, you can also withdraw cash without a debit card. This feature is particularly useful if you frequently travel. Using the app can be as simple as logging in and downloading the app.

Read more content on Journal fact

Financial Management Capabilities

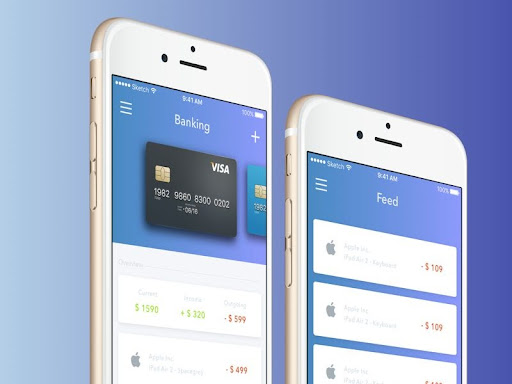

A good banking app will include basic financial management capabilities such as account balance monitoring and transaction history, and it will also let you make transfers. More than that, the app can be customized to fit your needs. Some apps even allow you to set goals for yourself. For example, you can set a goal to save money and track progress towards it, and the app will make it easy to accomplish that goal. A great app will also help you save money and make it easier to budget.

Easy to Use

A good banking app should be easy to use. It should allow you to manage your accounts. Moreover, a good banking app will also allow you to monitor your transactions. A user can choose between different options, depending on their needs and the type of account they have. The Banking App should be able to do a lot more than the usual. A great one will have more features than just an account management page. It should be able to do more.

A Banking App should integrate with the website. The user experience is key. You should be able to navigate the app easily and understand how it works. Your app should also be easy to use. You can even schedule bill payments and make your money transactions. If you are planning on building a user friendly Mobile App, Custom Software Development Company Denver design app that include tools to help you reach your goals. Some banks believe that a cash back service is enough, but that’s not the case.

7 features your online banking & mobile app should have

1. Account activity has been updated

The most fundamental aspect of your financial institution’s electronic banking or mobile application is the provision of recent account activity. It is easy to track your assets and control this activity regularly. Key points to note are:

Transactions: These transactions make your account and deposit funds into your account (eg direct deposits and checks) and include funds from your account (eg debit card payments and cash withdrawals).

Each transaction contains a date, a description and an amount. Be sure to check the details to make sure there are no unknown charges in your case.

Hang / Hold: You can also see the transaction under your account name, which means you are not logged in or fully registered.

Balance: In your professional account, you can also see the balance of your account after each deposit or withdrawal, so you know how much money is in your account.

Search: It’s also important that your account activity includes the search function, so you can easily view an invoice, check an image, find out, etc. at a specific time.

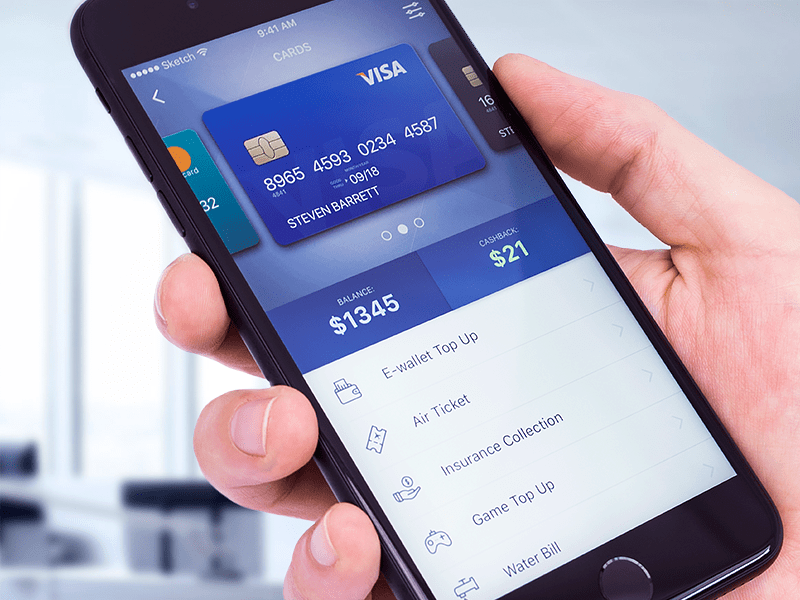

2. Verify account balance

Want to learn how to check your online account balance? With online and mobile banking, you have instant access to your account balances anywhere, anytime. This gives you the advantage of knowing how much you have available before you make your next purchase. An added bonus if your financial institution has a feature that allows you to control your balance without being logged in to your account, saving you an extra ranking.

An important difference is the current balance and the available balance. For example, if you deposit $ 200 for $ 200, but only have $ 100 available until the purchase completion process is complete, your current balance will pay off the full $ 200, but your account only has $ 100 $$ available for your credit . This is important to note, especially if you have a balance in your account that you do not need to spend more than a balance on your account.

3. Account transfer to account

If you have multiple accounts at a financial institution (such as a cash and savings account), it is important that you can easily transfer money to finance or finance your savings account. Instead of visiting your bank in person and filling out the link, users online or through their mobile app can transfer money instantly between bankers’ internal accounts with just a few clicks on their screen. This is useful for those who regularly use different methods or are looking for budget or resource flexibility.

4. Transmission from person to person

With person-to-person (P2P) transfers, you can quickly and easily send money to your friends and family using your phone. Popular mobile applications include PayPal and Venmo. Cell® is also a popular choice and an added advantage that online banking services and mobile applications are available at some financial institutions. Are you looking for online banking with Zelle®? Check if your bank offers it – simple description!

5. Bank transfer

A bank transfer allows you to transfer money between different external accounts if you have more than one bank. This is useful if you have other suggestions or are in the process of switching financial institutions, especially if you are moving to a business location near one of the banks. Make sure you note the time frame for bank transfers to a bank, as these tend to take longer than a direct account, so that the account transfer between your accounts takes place in one place.

6. Portable storage space

If you’ve ever been on the checklist because you did not have time to go to the bank before booking, your phone is the answer. This feature allows you to scan or check a photo through your mobile app and then deposit the money into your account as if you were yourself.

7. Check deleted images

If you pay by check, copies of these prints will be available online as soon as the transaction is completed. You can view these photos by logging in to your email account, which can

Integrated With the Website

Having a Banking App that is fully integrated with the website can make the entire process easier for your customers. They can view transaction history and see if there’s any activity on their accounts. A Banking App can also integrate creative features such as goal-setting, which lets users set savings goals. Creating a saving plan and achieving it can help a person achieve their financial goals. There are many types of banking apps available for users, so you should find one that suits you and your needs.

Allow Personal Account Management Page

Most banking apps offer some type of account management functionality. You can monitor the balance of your accounts and make transfers between different accounts. Some apps will allow you to set up goals and track transactions easily. You can also track your investments and earn cashback. You can even save for your retirement by setting up goals in your Banking App. A personal account management page is a great way to save time and money. It will also enable you to manage your accounts more effectively.

Integrate Payments from P2P

A good banking app will have many useful features. A good one should have a bank’s website integrated with the app. Whether you’re using a banking app on your smartphone or a desktop computer, it should be compatible with your existing accounts. By integrating your website and an application, your customers will be more satisfied with your banking experience and feel less reliant on your bank. You can even integrate payments from P2P apps into your Banking App if it’s compatible with the platform.

App Should have An Integrated Map

A good banking app should have an integrated map. The location of branches and ATMs is a major concern for consumers. The app should have a convenient way to find the nearest branch or ATM. A good app should be integrated with Apple and Google Maps. A map of the working hours of the branches and ATMs is a nice touch. Besides, a Bank App can also offer useful information about the work of the bank’s customer support agents.

Offer Advanced Security Features

A Banking App should offer advanced security features. A bank account management page can give users an insight into their balance and transactions. A bank app should also enable users to transfer funds between accounts. Apart from being convenient, the Banking App should also offer security. The best banking app should also be easy to use. If you want to stay safe online, you should choose Novateus to design an app that provides good protection against cyber theft. A well-integrated app will protect your money from hackers.